zip lines and con jobs

This week brings news from several different parts of the creationist battlefront. Even as Louisiana failed to overturn its recent law allowing the teaching of creationism in public schools (despite nationwide pressure led by student Zack Kopplin), there was some more revealing news from the two biggest creationist organizations in America:

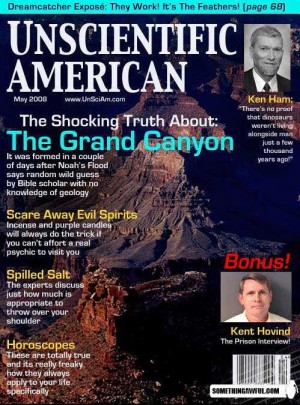

1) In an earlier post, I discussed the decline in attendance and loss of money from Ken Ham’s “creation museum” in Kentucky. Now even they must pay attention to the problem, since the declining attendance has put a crimp in their budget and brought the fundraising for their “Ark encounter” to a standstill. Their problem, as I outlined before, is that their exhibit is 5 years old now and has not changed, so most of the local yokels who might want to visit it have done so. There’s no point to making the long trip and seeing the expensive “museum” again if there’s nothing new to see. (Unlike real science museums, which must change exhibits constantly not only to boost repeat attendance, but to reflect the changes in scientific thinking). As Mark Joseph Stern wrote on Slate.com:

There could be another explanation, though. A spectacle like the Creation Museum has a pretty limited audience. Sure, 46 percent of Americans profess to believe in creationism, but how many are enthusiastic enough to venture to Kentucky to spend nearly $30 per person to see a diorama of a little boy palling around with a vegetarian dinosaur? The museum’s target demographic might not be eager to lay down that much money: Belief in creationism correlates to less education, and less education correlates to lower income. Plus, there’s the possibility of just getting bored: After two pilgrimages to the museum, a family of four would have spent $260 to see the same human-made exhibits and Bible quote placards. Surely even the most devoted creationists would consider switching attractions for their next vacation. A visit to the Grand Canyon could potentially be much cheaper—even though it is tens of millions of years old.

So how did they deal with the attendance dilemma? Did they open some new galleries with “latest breakthroughs in creation research”? (No, that’s not possible because they don’t do research or learn anything new). No, they opted for the cheap and silly: make it into an amusement park with zip lines. Apparently, flying through the air for a few seconds suspended from a cable is the latest fad in amusements, so the Creation “Museum” has to have one to draw the crowds—and hope they can suck in a few visitors to blow $30 a head or more to see their stale old exhibits as well. Expect that by next year they’ll be a full-fledged amusement park with roller coasters and Tilt-a-whirls, just like so many other “Biblelands” do across the Deep South.

And what do ziplines have to do with creationism? As usual, they have a glib and non-responsive answer:

Zovath’s response to the museums critics who wonder how zip lining fits with their message?

“No matter what exhibit we add, the message stays the same,” Zovath said. “It’s all about God’s word and the authority of God’s word and showing that all of these things, whether it’s bugs, dinosaurs or dragons – it all fits with God’s word.”

I was hoping for something more imaginative and relevant, like “zip lines make you feel like an angel flying down from heaven.”

2) Our old friends at the Discovery Institute in Seattle (the main organization which once promoted the “intelligent design” argument until it died in court in 2005) are doing some very shady fundraising and bookkeeping. Their site is constantly beating the bushes to get religionists to contribute to them, and they have extensive funding from a number of right-wing foundations that want to promote religion in public society and get around the 1st Amendment separation of church and state. They have a budget that is ten times the size of what their main opponent, the tiny National Center for Science Education, has to spend. They claim to be a tax-exempt non-profit, yet they also claim not to be a religious organization.

So on what basis are they tax exempt? Are they really a charity which spends most of its funds on social welfare? The website Cenlamar.com dug into the 990 tax forms for the Discovery Institute, and found some remarkable things. Almost 90% of the money they raise goes to salaries of their “research fellows,” plus lawyers, lobbyists, administrators, overhead, and expenses. No more than 13% could go to what could charitably be called “research,” although they don’t actually publish ANY peer-reviewed research, only stuff for their own house journals, and PR documents to push their cause. As their founding document, the “Wedge Strategy”, pointed out at the beginning, their motive isn’t to discover new science; it is conduct a PR campaign to get their viewpoint equal time in public schools and elsewhere in the media and public discourse, and skip the hard, complicated process of doing the scientific research that might support their position. As Cenlamar.com points out, however, 90% spending on overhead and salaries is WAY out of line for a non-profit charity. By contrast, organizations like the BBB Wise Giving Allowance or American Institute of Philanthropy spend no more than 35-40% on the same thing, and the United Way spends only 20%. This is typical of most non-profit charities, and clearly the Discovery Institute is not following the normal guidelines for non-profts.

So how do they get away with it? They use a clever sleight-of-hand to dodge the IRS guidelines for tax-exempt charities. They make “grants” to something called the “Biologic Institute”, which is a wholly-owned subsidiary of the Discovery Institute. Then the Biologic Institute spends this “grant” money for more salaries and overhead. Even though they claim to the IRS that they are funding grants, they are essentially sending the grant money to themselves to dodge the tax structure. I’m not familiar with the tax laws, but this sounds like a pretty shady deal which clearly violates the spirit if not the letter of the tax laws. As Cenlamar.com shows, it’s a “con-profit”, not a real non-profit. It’s a great con job which allows them to essentially spend all their money on their PR campaign and their staffers, with no obligation to do actual research, or to send money outside their own building.

So much for the honesty of these “Christian” creationists….

There’s a rather ugly air of schadenfreude in this piece. I guess it’s human to want to gloat, but it certainly doesn’t give one either moral or intellectual authority.

It is about time that religious organizations in general, and sideshows like the Discovery Institute and the Creation “Museum”, have their nonprofit status revoked. They should be required to pay their fair share.

I don’t know what I would do if Texas passed a law like this… let my super atheist 13 year old point out the fallacies and get suspended, or let him excel in a class that he feels teaches lies (guess that would piss off whomever put the law in place).

Seems somewhat like a Catch 22.

“There’s a rather ugly air of schadenfreude in this piece.”

Ugly because fraudulent practices might be exposed? Or ugly because schadenfreude is not to your liking.

If an enemy falls flat on his or her face – what is there not to enjoy?

Or did you not gloat when the russian empire fell in the eighties?

Or is schadenfreude only seen as proper when it is about your enemies?

Or do you posit because you do not feel schadenfreude that this makes you morally superior? Is schadenfreude a moral failing? Funny, I remember the gloating of the US press when they found a former employee of the CIA and the Foreign affairs department, a certain Saddam Hussain, rather bedraggled in a shelter. Or the schadenfreude of the US population when Osama Bin Laden was killed. But I guess your condemnation of schadenfreude is applied by you in all of this instances, making you a truly superior moral entity.

Mr. Prothero,

I’m no fan of the Discovery Institute, but…

“Are they really a charity which spends most of its funds on social welfare?”

No, but this isn’t what they claim to be. As cenlamar.com acknowledges in passing, DI self-identifies as a think tank. It is not, nor does it purport to be, primarily a grant-distributing or service-providing charity. Think tanks hire thinkers, and pay them to conduct research and write policy papers. There is absolutely nothing “dodgy” about this.

“…they don’t actually publish ANY peer-reviewed research, only stuff for their own house journals, and PR documents to push their cause.”

Again, they are a think tank. This is not out of line with what they claim to be doing. A few posts ago, you castigated Rep. Lamar Smith as a clown for wanting to subject NSF grants to political scrutiny and for members of Congress to decide what counts as “good science”. Yet here you seem to want the IRS to do exactly the same thing, and deny tax exempt status to any organization which doesn’t do “real research”.

“…organizations like the BBB Wise Giving Allowance or American Institute of Philanthropy spend no more than 35-40% on the same thing [salaries and overhead], and the United Way spends only 20%.”

Ok, first a nitpick. The numbers you quote from cenlamar.com are NOT what those organizations themselves spend on salaries and overhead; they are the maximum amounts of spending on those categories which those organizations recommend for non-profits. More importantly, if you actually look at the details of those organizations’ recommendations, what they are actually comparing is the percentage of spending on fund-raising and general overhead vs. what is spent on the actual services provided. And, again, DI is a THINK TANK. The salaries of “thinkers” and funding of “house journals, and PR documents to push their cause” IS the “service” they are providing.

“Even though they [the Discovery Institute] claim to the IRS that they are funding grants, they are essentially sending the grant money to themselves to dodge the tax structure.”

DI isn’t using grants to itself as a “dodge” to cover up the percentage of its spending it devotes to salaries and overhead, as you seem to be claiming. According to the source you link to, DI publicly declares that 87% of its revenues are spent in these categories. The purported “dodge” is that half of its supposed 13% spending on programs and grants is actually also going to salaries for three individuals, which would bring its spending on salaries and overhead from the publicly declared 87% to a “true” figure of 93.5%. Not much of a dodge.

“I’m not familiar with the tax laws, but this sounds like a pretty shady deal which clearly violates the spirit if not the letter of the tax laws.”

This just…what? You say yourself you don’t know what the actual tax laws are, yet you are confident that the Discovery Institute is somehow violating them. Because…creationists?

Ok, that was perhaps overly snarky, but…I’m seriously at a loss here. I usually enjoy your posts here at skepticblog, and generally consider you a thoughtful, well-informed commentator. But how can you possibly criticize DI for “dodging” tax laws when you don’t actually know what the relevant tax laws say?

DI claims tax exemption under section 501(c) (3) of the Internal Revenue Code. From wikipedia:

“501(c)(3) exemptions apply to corporations, and any community chest, fund, cooperating association or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, to foster national or international amateur sports competition, to promote the arts, or for the prevention of cruelty to children or animals.”

Even if the IRS gets into the business of deciding what’s “real” science, and decides that isn’t what DI is doing, they pretty clearly seem to fall under “religious…or educational purposes.” Even if you don’t agree with the religious views they are pushing, or the educational purposes they are pursuing.

Consider yourselves lucky, those tricky US tax-law hurdles (whatever they may be) are a far higher to jump than in Australia where “advancing religion” itself is enough to classify you as a charity, thus tax-free.

And how the Aussie Tax Office defines religion? Loosely. “Supernaturalism” + “Moralizing”…

http://notmyreligion.tiddlyspot.com/#%5B%5BTax%20Exemptions%5D%5D

…helping to boost the $$$ for such global charities as scientology.

How much of the money raised by the Skeptics Society goes to “salaries, lawyers, lobbyists, administrators, overhead, and expenses” and how much pays for peer-reviewed research?

According to their 2011 IRS form 990, out of about $787k in expenditures, the Skeptic Society spent:

$15k on “other employee benefits” (despite claiming 0 employees – nothing on actual salaries)

$1.6k on accounting services

$234k on printing and postage

$217k on Skeptic Magazine

$62k on speaker fees (presumably for the monthly lecture series at CalTech they sponsor)

$48k on Geology Tour expenses

$204k on “all other expenses” (a breakdown of this category is provided as supplemental info: about $100k of it looks like general overhead and administrative expenses, which for some reason is not claimed as such on Part IX of the form, $42k is for merchandise for resale, $32k is for “outside contract services”, and $27k is for merchant services).

Grants: $0.

No mention of any expenditures on research.

One other oddity: President Michael Shermer and CFO Pat Linse are both listed as receiving $60k salaries from unspecified “related organizations”, but nothing directly from the Skeptic Society itself. If the “related organization” is Skeptic Magazine (both are listed on the masthead, as publisher and co-publisher), then 55% of the Skeptic’s Society’s claimed expenditures on Skeptic Magazine are actually going to salaries for two Skeptic Society officers.

I just looked at the 2011 IRS form 990 for the National Center for Science Education (the latest year available). Guess what percentage of their spending went to “salaries, lawyers, lobbyists, administrators, overhead, and expenses”?

100%

It spent over 73% of its budget just on employee salaries, expenses, and benefits. And its lobbying expenditures accounted for over 21% of its total spending!

Please note, I am not knocking the NCSE at all. I am absolutely not accusing it of any sort of impropriety. Far from it. The point is, DI’s spending is absolutely in line with other non-profits, including the “good ones”, who are engaged in the same sort of enterprise.

Ncse and skeptic society don’t claim to do scientific research. Discovery institute claims that its their main focus yet spend less than 13% on it. Big difference!

1. You were the one who contrasted the NCSE to the Discovery Institute.

2. You specifically criticized DI for spending almost 90% of its budget on “salaries…lawyers, lobbyists, administrators, overhead, and expenses” because “90% spending on overhead and salaries is WAY out of line for a non-profit charity.” It was in response to this specific criticism that I pointed out that NCSE spends 100% of its budget in these same categories.

3. You claim that DI claims scientific research as its main focus. From DI’s 2011 IRS Form 990, in both Part I.1 and Part III.1, DI describes its mission as “To promote thoughtful analysis and effective action on local, regional, national, and international issues.” No mention of conducting or sponsoring scientific research.

Or take a look at DI’s “about us” page on its website at www DOT discovery DOT org/about DOT php. No mention of DI conducting or sponsoring any scientific research, but plenty on DI commenting on such research. To be fair, DI’s statement about its Center for Science and Culture does seem to imply that it conducts or sponsors some sort of scientific research to demonstrate ID and disprove materialism, but that’s hardly a claim that such research is DI’s main focus.

4. You repeat that 13% spending statistic. That is simply not how much DI claims it spends on research. That is how much it claims it spends on grants. “Grants” do not equal “Research”. An organization could spend all of its money on research it does itself. In point of fact, there is no line item or category on an IRS Form 990 for “research spending”, so it is impossible to tell from that form how much DI spends on research.

5. Both you and CenLamar seem to have badly misread the IRS Form 990. Part IX: Statement of Functional Expenses seems to be where CenLamar, and you, derived the spending statistics of 13% on “research” and 87% on “overhead”. In fact, Part IX of DI’s 990 puts grant allocations, not “research”, at about 13% of total expenditures. The other categories, which you and CenLamar lump together as “salaries…lawyers, lobbyists, administrators, overhead, and expenses” are actually further broken down as “program service expenses”, “management and general expenses”, and “fundraising expenses”. Again, there is no line item or category for “research”. If DI were operating biology labs and conducting field expeditions to collect specimens, this is precisely where those expenditures would be reported, as “program service expenses.” Almost exactly opposite to what you and CenLamar claim, DI claims it spends over 88% of its expenditures on program services and expenses, about 7% on fundraising, and only about 5% on administrative expenses and overhead (which, by the way, puts them way BELOW the recommended maximums for spending in those categories for non-profits, not far in excess, as you claimed).

6. To be thorough, let’s compare DI to a well-known scientific research non-profit, the Marine Biological Laboratory at Woods Hole.

*Grants: 9% [DI: 13%]

*”salaries…lawyers, lobbyists, administrators, overhead, and expenses”: 91% [DI: 87%]

Or, more accurately,

*Program Service Expenses (includes grants): 94% [DI: 88%]

*Management and General Expenses: 4% [DI: 5%]

*Fundraising Expenses: 3% [DI: 7%]

CenLamar, whatever that is, did look into the program service expenses, the bulk of which are for “Production of public service reports, legislative testimony, articles, public conferences and debates, plus media coverage and the Institute’s own publications in the field of science and culture.”

Lamar concludes that “By listing its activities as the production of ‘public service reports’ and the presentation of ‘legislative testimony,’ the Discovery Institute is effectively disclosing that it is primarily a lobbying organization, not a think tank.”

I don’t know, sounds similar to skeptical/secular nonprofits to me. Besides, a lot of think tanks act like lobbying organizations.

http://www.thenation.com/article/174437/secret-donors-behind-center-american-progress-and-other-think-tanks-updated-524

Yeah, the original CenLamar post is largely about the idea that DI is primarily a lobbying organization, which would be a violation of its 501(c)3 status.

But, as you rightly point out, what DI seems to be engaged in is the “soft lobbying” typical of think tanks.

By the way, the statement about DI’s program service expenses you quoted comes from Part III.4 of the 990, where the filer is required to “Describe the organization’s program service accomplishments for each of its three largest program services, as measured by expenses.” DI does this for four programs, including the one you quote. The Skeptic Society, in its 2011 Form 990, just briefly restates its mission statement, and lists its program expenses as a single lump sum, rather than breaking out the three largest programs, as required.

The more I look at their respective 990s, the shadier the Skeptic Society looks compared to DI. DI’s spending is actually much more transparent. To be fair, DI’s 990 overall just looks like it was more professionally and thoroughly prepared (they did spend over $50,000 on outside accounting services, compared to Skeptic Society’s $1,675), but still…

I disagree that the ziplines are silly. They are good business. I would pay $30 to go ziplining (assuming they’re cool) — that’s a good price. It’s a draw, and it will funnel more people through the museum. If I could add a zipline option to my podcast, you bet I would.

But zip lines really have nothing to do with the Bible,so they are just a gimmick.

What Hamm has missed is a trick that the mass media has known about for a long,long time: He needs to incorporate all of the sex and violence themes and stories that are in the Holy Bible.

That should bring them in and keep them coming in by the thousands.And it has the added benefit of actually being the ‘Word of God’.